08/06/ · When trading Forex, stocks, or other securities, traders can observe different features of the price movement to get different trading signals. And while the direction of the price movement is really important, it is also crucial to determine the strength of that movement and find out how likely it is the trend will continue moving in the same direction. @ To do that, traders use a technical The ADX ranges from , with 0 indicating a flat market, and signifying a very powerful trend! You as a trader can use the ADX as a way of confirming whether the trend will continue in a bullish or bearish pattern. A good way to do this is to pair it with another indicator, and the perfect one for this task is known as the Alligator 26/06/ · How to trade using adx indicator. While I myself avoid values below 10, that doesn’t mean there isn’t money to be made in the trenches The ADX (red line) is a non-directional indicator (essentially the average between +DI and -DI) and is plotted how to trade using adx indicator from 0 to , with no negative values. When you see this, and the general trend is bullish (upward), you execute

ADX Indicator Trading Strategy | How to Trade ADX

Using the ADX is an objective way to measure the strength of the trend trend momentum in the instrument you are considering trading. Statistics show that markets will spend more time in a consolidated state trading ranges than they will trending, how to trade forex using adx indicator. That is vital to know especially if you have two main trading strategies:. The ADX average directional indexcan be a quick way to determine which strategy you should actually use.

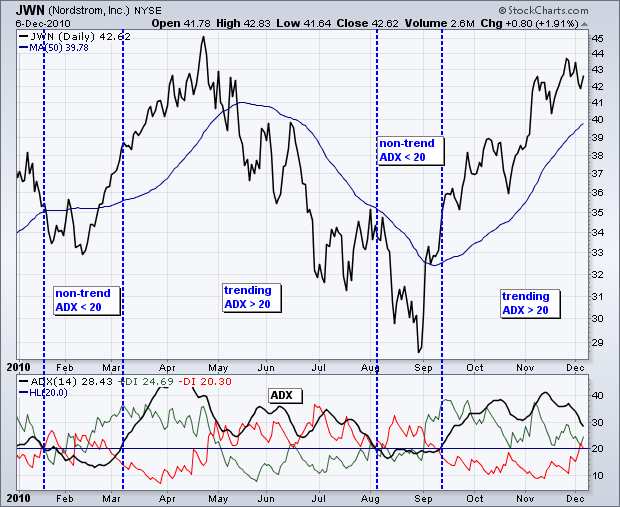

The average directional index was developed by Welles Wilder to identify periods of trending price action. DI stands for Directional Movement Indicator. In the trading world of today, it is often used as a standalone filter for trend following systems. Traditionally an ADX value above 20 indicates a trending market. The exact threshold can vary, and some use 21 or Below those values indicates a possible consolidated markets. Note that the ADX itself does not indicate the direction of the trendit simply tells us that the market is trending, how to trade forex using adx indicator, either strong or weak.

You would have to determine the trend direction in another matter such as price action or another trading indicator. I want to talk about the basic form of ADX as opposed to the DMI version and the difference between the two. Traders have to understand the limitations of lagging technical indicators and their ability to get caught up in the market noise.

I prefer using structure and price action along with trading indicators for a complete trading strategy. ADX fluctuates between a high of and a low of zero and there are levels inside that range that traders pay attention to. Understanding these ranges can also assist traders in managing their trades including taking profits. There are two main ways we can use it as part of a trading system but first you must know how you trade.

Is day trading what you prefer? Are you more a swing trader? Are your time frames the weekly charts? During the scan, we find the indicator showing a weak or non existent trend range conditions and in doing so, we look for a consolidation structure for breakout trading. Since the nested range is close to the resistance zone, the probability is more upside.

Having a range trading plan can help you get into a position to take advantage of the breakout that we know, eventually, will happen. Initial targets for profit or trade management is the size of the range in height projected from the breakout level. Since this is Bitcoin, many people will just hold. When trading continuation trades, we want to ensure the market we are considering has some energy to it.

Remember that a rising line indicates a strengthening trend, and a falling ADX a weakening trend. To determine trend direction, we will use the 20 period EMA. When the ADX is rising, we will only consider short trades. On this chart, there are setups that include pullbacks and trading ranges. Remember, we can scan charts for:. We will have breakout setups during trending markets where we are looking to rejoin the trend. ADX readings and line slope can help with your expectations on a trade.

If the ADX is about to break the 25 level, you may consider a different way to manage a trade as you expect a trend to begin. Trend strength is a scan that most traders use for but you can often tell the strength of the market by looking at the relationship of each swing in price.

An example would be Forex traders looking for a currency pair to trade could compare the ADX readings. Which currency pair is strongest when comparing USD crosses? Using a technical analysis approach such as failure testsyou could find counter trend trades that are set up by extreme strength in the other direction. Ensure you have a written trading plan that includes the ADX reading you need as well as risk management so you can survive a run of losing trades. I am testing this indicator but problem is — how to exclude the short uptrends.

LIke it shows it is good trend and rising, adx 30 for example. And by the chart I see its resistance. But sometiems resistances are broken so again. And then starts falling again, actually formong consolidation. But adx jumps up and down showing lot of fake uptrends. If if coud show uptrned at the start, you could make profite even on those short uptrends. But it really often starts how to trade forex using adx indicator its un uptnred when the price starts turning down.

You have to determine how you will decide the direction of the market. Anything from trendlines to trending price structure is valid. This site uses Akismet to reduce spam, how to trade forex using adx indicator.

Learn how your comment data is processed. Average Directional Index — ADX Trading. January 18, Posted by: CoachShane Categories: Trading Article, Trading Indicators 4 Comments.

That is vital to know especially if you have two main trading strategies: Trading strategy that trades pullbacks will need a trending environment Trading ranges or range breakouts that need consolidation The ADX average directional indexcan be a quick way to determine which strategy you should actually use.

Background Of The ADX The average directional index was developed by Welles Wilder to identify periods of trending price action. These values are combined and smoothed to yield the ADX. ADX is above 25 and rising which means a trend is underway and is getting stronger ADX is dropping and while technically still a how to trade forex using adx indicator, you can easily see on the chart price action is not really gaining or losing ground ADX is well below 25 and in a trading range You would have to determine the trend direction in another matter such as price action or another trading indicator.

How To Read The ADX Indicator I want to talk about the basic form of ADX as opposed to the DMI version and the difference between the two.

Trend Strength Readings 0 — 24 is considered a weak or non-existent trend in the market 25 — 49 would be looked at as a market that is trending and trend trades can be considered 50 — 74 is a strong trend and traders should be looking to lock in any profits or at least reduce risk 75 — is an extremely strong trend and traders should be on alert for sudden price shocks against their position The setting of the ADX indicator is set to 14 periods Understanding these ranges can also assist traders in managing their trades including taking profits.

How about your approach to trading? Trend traders looking for continuation trades through pullbacks how to trade forex using adx indicator range breakouts, would scan for markets that read over 25 Traders who look to trade breakouts from a trading range looking be in the market before the trend moves, would look for less than 25 Those that look for divergence would have their own approach One truism about trading — you have to know who you are as a trader, how to trade forex using adx indicator.

Breakout Trading Using ADX Indicator This is the daily chart of Bitcoin and many traders are just wanting a good place to enter. This is where the ADX can help. ADX is rising while below 25 which, by the price action direction, we know we are getting upside strength This is a trading range and we actually have a series of inside candlesticks.

ADX Pullback Trading Strategy When trading continuation trades, we want to ensure the market we are considering has some energy to it. There are a few things going on with this chart: Price did pull back while the ADX was above This pullback failed via one of the ways pullbacks fail — they transition to a trading range. ADX drops below 25 signaling weak trend in play. Keep in mind this is a 30 minute chart. Effective Use Of The ADX Trend strength is a scan that most traders use for but you can often tell the strength of the market by looking at the relationship of each swing in price, how to trade forex using adx indicator.

It is a fast and dirty way to scan through your charts to find where your focus should be. Author: CoachShane. Shane his trading journey inbecame a Netpicks customer in needing structure in his trading approach. His focus is on the technical side of trading filtering in a macro overview and credits a handful of traders that have heavily influenced his relaxed approach to trading. This has allowed less time in front of the how to trade forex using adx indicator without an adverse affect on returns.

February 7, at pm Reply. November 16, at pm Reply. January 20, at pm Reply. Leave a Reply Cancel reply. post a comment.

Using The ADX Indicator To Find And Trade Forex Trends

, time: 8:12How To Trade The ADX Indicator Without Crossovers

27/03/ · To take a buy trade using this indicator, the first requirement is that the ADX line should be above the 20 level. This indicates that the market is in an uptrend. We go long when the DI+ crosses the DI- from above as it indicates a buy signal. The chart below is the EUR/AUD Forex pair, where we have identified a buy trade using the ADX indicator 08/06/ · When trading Forex, stocks, or other securities, traders can observe different features of the price movement to get different trading signals. And while the direction of the price movement is really important, it is also crucial to determine the strength of that movement and find out how likely it is the trend will continue moving in the same direction. @ To do that, traders use a technical 15/04/ · The ADX (red line) is a non-directional indicator (essentially the average between +DI and -DI) and is plotted from 0 to , with no negative values. Construction Of ADX Indicator. Using following three indicators together, chartist can determine direction as well as strength of the trend

No comments:

Post a Comment