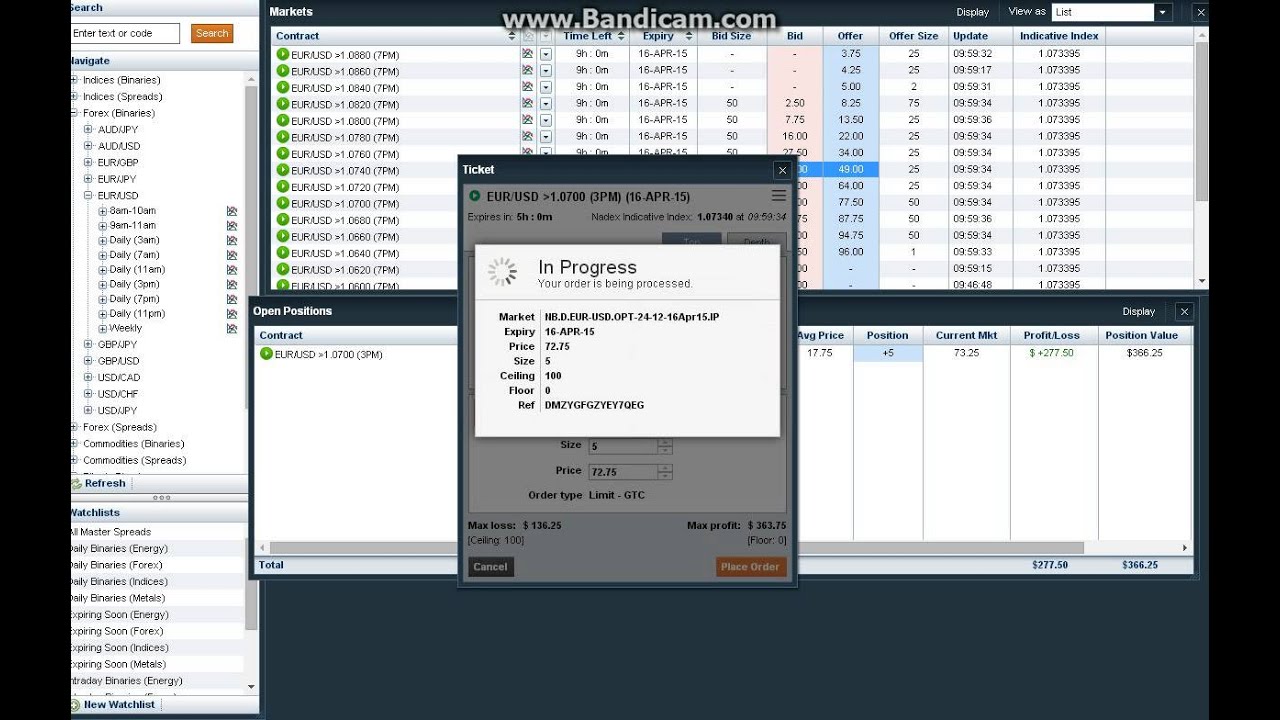

For this advance binary options trading strategy we will use Nadex Call Spreads. The main difference between “regular” Binary Options and Nadex Call Spreads is this: When trading Binary Options, you are simply choosing whether a market is trading above or below a certain level. In order to trade this Binary Option, you pay between $0 and $ There are two trades, or legs, involved to implement the strategy: Sell an in-the-money (ITM) binary option contract at $75 or greater. Buy an out-of-the-money (OTM) binary option contract at $25 or lower. You may want to set a limit order on both legs, typically around to 2 times the risk on either side of the trade. You can apply various technical indicators to your charts on Nadex to show support and resistance levels. Find out more about technical indicators, charts, and how to use them when trading binary option contracts. Variation on a condor spread The idea of range trading can be taken further and developed into a full strategy for trading flat markets.

⭐ Predicting nadex binary options strategy singapore ⭐ ✅ 's Best Trading Brokers

Most binary option platforms provide only predicting nadex binary options strategy choice: will the market go higher or lower in the next five minutes. There are different price levels strike prices for you to make your prediction around, which gives you various opportunities, predicting nadex binary options strategy. At-the-money ATM : the contract with a price level that is approximately the same as the current indicative price.

This example asks the question:, predicting nadex binary options strategy. An important note: the midpoint between the bid-ask prices is the market pricing the probability of the question being true.

Out-of-the-money OTM : a contract where the price level is above the indicative price, which means a lower probability of your prediction being correct. The midpoint between 16 and 24 is the market pricing the probability of the buyer being correct. They would pay less for this option since the indicative price is below the strike — the market would have to move higher for the contract to be profitable. As such, the potential reward is also higher. The mid-point between the bid and ask is the probability of the buyer being correct at that moment.

Be sure to understand the probability of success before entering a trade, whether buying or selling. This can help you to lock in profits or limit losses. Download a Nadex demo account. What are binary options and how do they work?

Back to Help. Account Help. Getting Started. Platform Tutorials. Nadex 5-minute binary options explained. Still have questions? Contact us. Practice trading — reach your potential Begin free demo.

Nadex Binary Options Trading- 900% Profit Strategy- No Scam or Software

, time: 10:42How to Trade 5-Minute Binary Options | Nadex

Most binary option platforms provide only one choice: will the market go higher or lower in the next five minutes. Nadex has various contract durations: 5-minute. minute. 2-hour. Daily. Weekly. There are different price levels (strike prices) for you to make your prediction around, which gives you various opportunities. Nadex 5-minute binary options: your choices At-the-money contracts. You can apply various technical indicators to your charts on Nadex to show support and resistance levels. Find out more about technical indicators, charts, and how to use them when trading binary option contracts. Variation on a condor spread The idea of range trading can be taken further and developed into a full strategy for trading flat markets. Sep 23, · The whole concept behind binary options is to predict whether the market is going to be above or below the current price at the end of the selected time period. The expiration dates are very short-term. In other words, the trading instruments offered by NADEX are short-term options.5/5(3).

No comments:

Post a Comment