12/03/ · The base currency is the first currency in a currency pair. It compares the values between the first currency and the second currency in a currency pair. In the forex market, currency unit prices are quoted as currency pairs. The base currency, which is also known as the t ransaction currency, is the first currency appearing in a currency pair Estimated Reading Time: 1 min 12/04/ · The base currency you choose doesn't have any impact on your trading or what pairs you trade, because forex accounts are margin accounts. But if possible, you should choose a base currency the same as your home currency, because by doing that you avoid to large conversion spreads the banks charge when you do a wire deposit or withdrawal Talking about the currency pair, it consists of abbreviations of both the currencies. One currency will be the base currency in this pair, while the other will be the quote or the counter currency. Every currency pair has an international code. For example, the EUR/USD translates to the value of one Euro that fetches $

Which base currency should I choose? – Support | QuickBooks Commerce

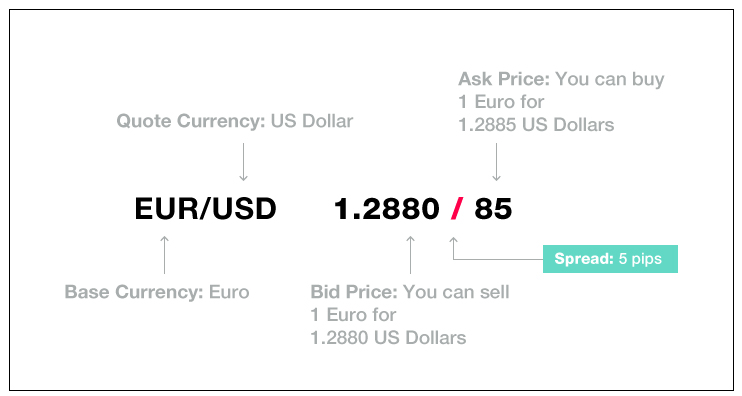

In the forex market, currency unit prices are quoted as currency pairs. The base currency — also called the transaction currency - is the first currency appearing in a currency pair quotation, followed by the second part of the quotation, called the quote currency or the counter currency. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses.

In forex, the base currency represents how much of the base currency option which one to choose forex currency is needed for you to get one unit of the base currency.

dollar would be the quote currency. The abbreviations used for currencies are prescribed by the International Organization for Standardization ISO.

These codes are provided in standard ISO Currencies constituting a currency pair are sometimes separated with a slash character. The slash may be omitted or replaced by a period, a dash or nothing. The major currency codes include USD for the U. dollar, EUR for the euroJPY for the Japanese yen, GBP for the British pound, AUD for the Australian dollar, CAD for the Canadian dollar and CHF for the Swiss franc.

Here, XXX is the base currency and YYY is the quote currency. When provided with an exchange ratecurrency pairs indicate how much base currency option which one to choose forex the quote currency is needed to buy one unit of the provided base currency.

The currency pair quotation is read in the same manner when selling the base currency. Forex quotations are stated as pairs because investors simultaneously buy and sell currencies. dollars at the same time. Investors buy the pair if they think that the base currency will gain value in contrast with the quote currency. On the other hand, they sell the pair if they think that the base currency will lose value in contrast with the quote currency. International Organization for Standardization, base currency option which one to choose forex.

Your Money. Personal Finance. Your Practice, base currency option which one to choose forex. Popular Courses.

What is Base Currency? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, base currency option which one to choose forex, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms What Is a Quote Currency? A quote currency, commonly known as "counter currency," is the second currency in both a direct and indirect currency pair. What Is a Reciprocal Currency? A reciprocal currency is a currency pair that involves the U. dollar USD without the USD serving as the base currency.

American Currency Quotation Definition An American currency quotation is how much U. currency is needed to buy one unit of foreign currency.

ISO Currency Code Definition ISO currency codes are three-letter alphabetic codes that represent the various currencies used globally. Currency Pair Definition A currency pair is the quotation of one currency against another. Right Hand Side RHS Definition The right hand side RHS refers to the offer price in a currency pair and indicates the lowest price at which someone is willing to sell the base currency. Partner Links. Related Articles. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

Currency options hedging

, time: 35:55Forex or Binary Options: Which one to choose

12/03/ · The base currency is the first currency in a currency pair. It compares the values between the first currency and the second currency in a currency pair. In the forex market, currency unit prices are quoted as currency pairs. The base currency, which is also known as the t ransaction currency, is the first currency appearing in a currency pair Estimated Reading Time: 1 min 25/08/ · blogger.com - Ever wondered the difference between Binary options trading and forex trading? Read on to find out the main differences so you can c 12/04/ · The base currency you choose doesn't have any impact on your trading or what pairs you trade, because forex accounts are margin accounts. But if possible, you should choose a base currency the same as your home currency, because by doing that you avoid to large conversion spreads the banks charge when you do a wire deposit or withdrawal

No comments:

Post a Comment